Category: “Medical Device Manufactures”

- Real-time locating systems (RTLS) in healthcare: a condensed primer

- Who knew – IDC is still in business. CCD DR is alive, any buggy whip manufacturers out there?

- Digital X-Ray Market Worth $8,710 Million by 2018

In terms of value, the global digital X-ray market size was estimated at $4,687.2 million in 2013 and is expected to grow at a CAGR of 13.2% in the next five years.

The report, “Digital X-ray Market by Application (Mammography, Dental, Chest Imaging), Technology (Computes, Direct), Portability (Floor to ceiling mounted, Ceiling mounted, Handheld), End User, Price segments, Flat panel detectors, Software – Global Forecast to 2018,” provides a detailed overview of the major drivers, restraints, challenges, opportunities, current market trends, and strategies impacting the digital x-ray market along with the estimates and forecasts of the revenue and share analysis.

- Global ultrasound market expected to flourish

The global ultrasound device market is expected to reach $8.7 billion by 2019, growing at a compound annual growth rate (CAGR) of 6.4 percent, according to a new Transparency Market Research report.

- Fuji gets FDA clearance – enters the Full Field Digital Mammography business in the US

- Toshiba releases new Interventional Cardiac Imaging solution

- U.S. Orthopedic Trauma Device Market To Exceed $8 Billion By 2020

- Compete against Cerner? Here are 10 things to know.

- Sectra continues to be a strong player in the PACS – RIS – Healthcare IT space

- Telemedicine – and the venders selling into that space – still has a bumpy road ahead

- Philips Healthcare commited to third-party service and xray tubes, CEO for their Dunlee division leaves

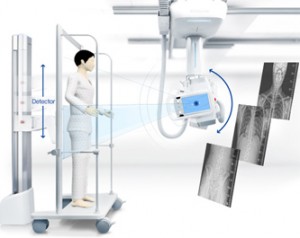

- DR on Xray Portables simply makes business sense

There exists clear clinical evidence that the latest digital radiography (DR) detector portable X-ray units allow for portable exams to be performed in almost half the time previously required for computed radiography (CR) and film-based exams.

- What Does the Future Hold for Medtech? One word – less

Healthcare reform is creating a future that is incompatible with the business models of today. Few of today’s companies are prepared. Expect winners and notable losers among even the biggest names in the medtech industry. “An industry accustomed to growth and high margins is quickly being forced into a world of stagnation and price erosion.” Expect 20% to 25% revenue decline and a consolidation of the mega-manufactures into less than a dozen companies. Large hospital systems will control the majority of purchases and distribution will shift to low-cost delivery channels.

- Digital Radiology (DR) catching up – becomes more than retrofitting analog rooms

- Not so fast Google says, regulation so bad that Entrepreneurs won’t be innovating Healthcare

"Generally, health is just so heavily regulated. It's just a painful business to be in. It's just not necessarily how I want to spend my time. Even though we do have some health projects, and we'll be doing that to a certain extent. But I think the regulatory burden in the U.S. is so high that think it would dissuade a lot of entrepreneurs."

- Premier more than a GPO – they are driving and funding innovation

$40 Billion Hospital Supplier Links Health Innovators With Clinicians. Forbes has a good article on how Premier and other deep pocked corporations are funding medical device manufactures and clinicians. "Innovation Celebration is hosted annually by Premier Inc., an alliance of about 3,000 U.S. hospitals and 110,000 other health services providers. As one of the nation’s largest purchasing alliances with more than $40 billion in annual hospital supply purchases flowing through the company, Premier has a unique perspective on what care providers need to better care for patients."

- Million dollar messaging – the key to having sales conversations and business development

1. Your buyers are saying one thing and doing another

2. There is a big difference between problem finding vs. problem solving

3. Facts alone don't create insight, nor appeal to the customer

4. Salespeople must practice in order to deliver messaging well

5. Timing, appropriateness, and delivery make or break communication

6. Goal is conversations - SALES - not Best Friends Forever BFF

7. Discounting is a marketing/sales problem

8. Give aways lose sales

- The loophole closes on Pharmaceutical companies being able to pay Physicians

CMS has proposed to close the loophole known as the Sunshine Act that allowed Pharmaceutical companies to pay Physicians under the guise of marketing. Now Pharmaceuticals have to play by the same rules as Medical Device Manufacturers.

- The Operating Room heats up as a buyer for advanced imaging technology

- Important: here are the rules you have to comply with on service – JCAHO speaks

In its ongoing quest to align its standards to those of the Centers for Medicare & Medicaid Services (CMS), The Joint Commission today issued another revision of its rules for preventive maintenance. This document also includes the rules that service providers must follow in order to be in compliance, such as record keeping, and safety checks after a major repair.

- How US healthcare companies can thrive amid disruption

McKinsey adds their insights into how to transform our business from a fee-for-service (volume - do more get paid more) to the new reality of outcome based reimbursement. Medical Device Manufacturers used to selling boxes and building ROI's based on volume won't survive under the new payment structure. "Although healthcare has been changing for decades—think about the introduction of diagnosis-related groups (DRGs) or the initial push toward managed care in the 1980s—the Affordable Care Act (ACA) promises to accelerate both the rate of change and the level of uncertainty confronting the industry."

- GE Healthcare shuffles Milwaukee-area execs after Medtronic hirings

- Philips changes its management structure

Philips decided in January to temporarily suspend production of PET/CT and SPECT/CT scanners in order to devote all of its time and energy to resolving the issue, said Klink. Philips is also looking to develop a new type of customer relationship and they're hoping this new management structure will accelerate that. "We see a bigger demand for partnership agreements where we team up with a hospital and we work through performance based revenue models rather than just selling an individual scanner," said Klink.

- Hologic to Release Third Quarter Fiscal 2014 Operating Results on Wednesday, July 30, 2014

- Is Google going to be the largest competitor to Medical Device Manufactures?

Medronic thinks so

- Seismic shock to big healthcare IT PACS RIS – Siemens out?

- Clinical decision-support (CDS) software becomes mandatory before ordering Imaging Studies

Starting January 1, 2017, physicians ordering advanced diagnostic imaging exams (CT, MRI, nuclear medicine and PET) must consult government- approved, evidence-based appropriate-use criteria, namely through a CDS system

- All Technology Sellers may be impaced by one this one study: Older women don’t benefit from new breast technology

This may be harbinger of a greater challenge for capital equipment sales and medical device manufacturers. Thought Leaders and the CMS are starting to demand equipment be based on CED structures (evidence development). In other words new technology must prove clinical efficacy before being sold or adopted.

“In a conversation with AuntMinnie.com, lead author Gross said the results of the study reflect a broader problem with U.S. healthcare: the adoption of new technologies that haven't been proved to improve patient outcomes. "There is a widespread belief in the American healthcare system that newer is better," Gross said, even as "there is virtually no evidence that these newer technologies are better or more effective in terms of saving lives and improving patient outcome..."

- There is big money in Infection Control

- The mandate to build a better medical device supply chain